Discover... Create... Live... your Best - Life! ™

Discover, Create, Live your Best Life

We Empower Smart Money & Best-Life Choices

Through "The DiNuzzo Way™" Core Principles As Evidenced In "The DiNuzzo Financial Wellness LifePlan™"

Discover, Create, Live your Best Life

Discover... Create... Live... your Best - Life! ™

We Empower Smart Money & Best-Life Choices

Through "The DiNuzzo Way™" Core Principles As Evidenced In "The DiNuzzo Financial Wellness LifePlan™"

DiNuzzo Wealth Management: At A Glance

As of Mar 31, 2022

- As of December 31, 2021

- 32nd Year in Business in Southwestern Pennsylvania

- $897M Assets Under Management

- 165 Years of Combined Wealth Advisor Experience

- 33 States are Home to DWM Clients

- Credentials: *CFP: 5 , *CPA: 1 , *PFS :1, *EA: 2, *ChFC: 5, *AIF: 8, *AAMS: 1, *MBA: 3, *MSTx: 1, *MSFP: 1, *MS: 1

Credentials & Designations

DiNuzzo Wealth Management: At A Glance

- As of December 31, 2021

- 32nd Year in Business in Southwestern Pennsylvania

- $929M Assets Under Management

- 163 Years of Combined Wealth Advisor Experience

- 33 States are Home to DWM Clients

- Credentials: *CFP: 5 , *CPA: 1 , *PFS :1, *EA: 1, *ChFC: 5, *AAMS: 1, *MBA: 3, *MSTx: 1, *MSFP: 1, *MS: 1

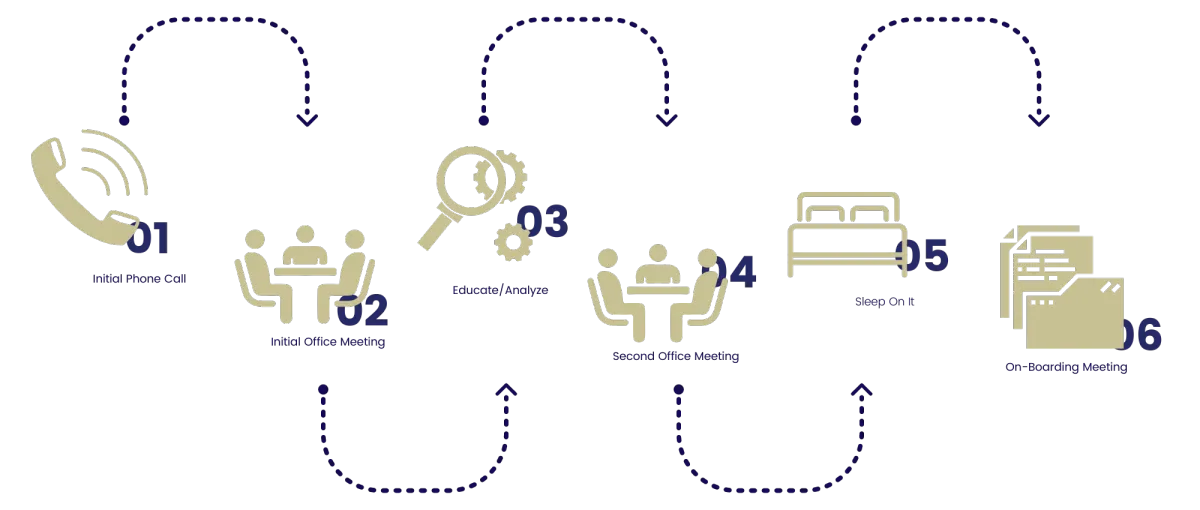

SIX STEP PROCESS

Discover... Create... Live... your Best - Life! ™

Our Services

At DiNuzzo Wealth Management Our Goal is to be Our Client's Most Trusted Advisor.

- DINUZZO FINANCIAL WELLNESS LIFEPLAN

- DINUZZO MONEY BUCKET STACK ANALYSIS

- CAPITAL GAIN HARVESTING

- SEMI-ANNUAL PROGRESS MEETINGS

- DAILY PORTAL PORTFOLIO ANALYTICS REPORTS

- REGULAR COMPLIANCE AUDITS

- WEALTH PLANNING TEAM AUDITS

- DAILY PORTAL CAPITAL GAINS & TAX REPORTS

- CLIENT SERVICE SPECIALIST REVIEWS

- DINUZZO FINANCIAL WELLNESS LIFEPLAN

- DINUZZO MONEY BUCKET STACK ANALYSIS

- CAPITAL GAIN HARVESTING

- SEMI-ANNUAL PROGRESS

- DAILY PORTAL PORTFOLIO ANALYTICS REPORTS

- REGULAR COMPLIANCE AUDITS

- WEALTH PLANNING TEAM AUDITS

- DAILY PORTAL CAPITAL GAINS & TAX REPORTS

- CLIENT SERVICE SPECIALIST REVIEWS

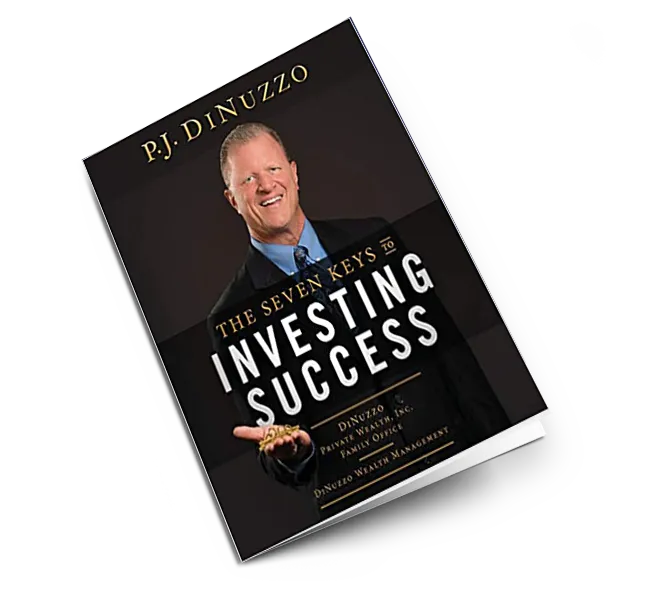

The seven keys to investing success

The seven keys to investing success

who we serve

At Dinuzzo Wealth Management Our Goal is to be Our Client's Most Trusted Advisor.

Within 5 Years of Retirement or Retired

Planning your retirement five years before you retire provides you with the most tax and financial planning opportunities.

Diligent saver

While our clients would hardly consider themselves to be “rich”, thanks to a lifetime of diligent saving and frugal living they have accumulated a retirement nest egg of at least $1,000,000.

Nice people

This might sound cliché, but we will only work with genuinely nice people with whom we share a mutual respect.

Looking for a trusted advisor

Our clients understand that the success of their retirement is too important to be doing it themselves, and they understand the value of having expert guidance.

who we serve

Within 5 Years of Retirement or Retired

Planning your retirement five years before you retire provides you with the most tax and financial planning opportunities.

Diligent saver

Nice people

Looking for a trusted advisor

P. J. DiNuzzo

Founder, President, Lead Consultant

P. J. DiNuzzo is the Founder, President, Chief Investment Officer (CIO), Chief Compliance Officer (CCO), and Director of Business Development for DiNuzzo Private Wealth, Inc./DiNuzzo Family Office/DiNuzzo Wealth Management, which has operated as an SEC Registered Investment Advisory Firm since 1989 and currently manages $897 million in assets under management as of Mar 31, 2022.

P. J. has devoted his entire professional career to indexing/efficient market theory, retirement planning and educating the public regarding their benefits. He was approved as one of the first 100 Advisors in the United States with Index Research/Development Leader and Institutional Mutual Fund Manager, Dimensional Fund Advisors (DFA) in the early 1990’s.

P. J. DiNuzzo

P. J. DiNuzzo is the Founder, President, Chief Investment Officer (CIO), Chief Compliance Officer (CCO), and Director of Business Development for DiNuzzo Private Wealth, Inc./DiNuzzo Family Office/DiNuzzo Wealth Management, which has operated as an SEC Registered Investment Advisory Firm since 1989 and currently manages $883 million in assets under management as of September 30, 2021.

P. J. has devoted his entire professional career to indexing/efficient market theory, retirement planning and educating the public regarding their benefits. He was approved as one of the first 100 Advisors in the United States with Index Research/Development Leader and Institutional Mutual Fund Manager, Dimensional Fund Advisors (DFA) in the early 1990’s.

Our TEAM

Front Stage

P. J. DiNuzzo

Founder, President, Lead Consultant

Read Bio

Read Bio

Mark S. DiNuzzo

EVP, Principal, Financial Wellness LifeCoach, Risk Management Team Leader

Read Bio

Carl J. Hartman

SVP, Principal, Financial Wellness LifeCoach, Senior Investment Officer

Read Bio

Read Bio

Michael V. DiNuzzo

SVP, Principal, Financial Wellness LifeCoach, Risk Management Team Leader

Read Bio

Robert F. Graham

VP, Financial Wellness LifeCoach

Read Bio

Read Bio

Jacob R. Potts

VP, Financial Wellness LifeCoach, Trade Team Leader

Read Bio

Read Bio

Leslie D. Taylor-Neumann

Read Bio

Jennifer B. Reddinger

VP, Financial Wellness LifeCoach, Tax Team Co-Leader

Read Bio

Read Bio

Kenneth M. McDaniel

VP, Financial Wellness LifeCoach, Tax Team Leader

Read Bio

Read Bio

Our TEAM

Front Stage

P. J. DiNuzzo

Founder, President

Read Bio

Mark S. DiNuzzo

Read Bio

Carl J. Hartman

SVP, Principal, Financial Wellness LifeCoach, Senior Investment Officer

Read Bio

Michael V. DiNuzzo

Read Bio

Robert F. Graham

VP, Financial Wellness LifeCoach

Read Bio

Jacob R. Potts

VP, Financial Wellness LifeCoach, Trade Team Leader

Read Bio

Leslie D. Taylor-Neumann

Read Bio

Jennifer B. Reddinger

Read Bio

Kenneth M. McDaniel

VP, Financial Wellness LifeCoach, Tax Team Leader

Read Bio

Back Stage

Phyllis M. Nutz (DiNuzzo)

Read Bio

Jackie M. DiNuzzo

Read Bio

Lisa A. Faulkner

Senior Client Service Specialist

Read Bio

Read Bio

Terri S. Tepsic

Executive Assistant

Read Bio

Read Bio

Brooke C. McMaster

Senior Client Service Specialist

Read Bio

Read Bio

Rose M. Dessler

Compliance Officer

Read Bio

Jeffrey A. Buckley

Read Bio

Cliff Smith

Read Bio

Ken W. Aikens

Read Bio

Keri M. Ronacher

Read Bio

Renee J. Foody

Read Bio

Denise A. Lyons

Read Bio

Nicolas A. DiNuzzo

Read Bio

Suzanne M. Boren

Executive Assistant, Culture and HR Team Leader

Read Bio

P. J. DiNuzzo

CPA, PFS™, MBA, MSTx

Founder, President, Lead Consultant

Phone: 724.728.6564

Toll Free: 877.728.6564

E-mail: pjdinuzzo@dinuzzo.com

P. J. DiNuzzo is the Founder, President, Chief Investment Officer (CIO), Chief Compliance Officer (CCO), and Director of Business Development for DiNuzzo Private Wealth, Inc./DiNuzzo Family Office/DiNuzzo Wealth Management, which has operated as an SEC Registered Investment Advisory Firm since 1989 and currently manages $929 million in assets under management as of December 31, 2021. P. J. has devoted his entire professional career to indexing/efficient market theory, retirement planning and educating the public regarding their benefits. He was approved as one of the first 100 Advisors in the United States with Index Research/Development Leader and Institutional Mutual Fund Manager, Dimensional Fund Advisors (DFA) in the early 1990's. DiNuzzo Private Wealth, Inc./DiNuzzo Family Office/DiNuzzo Wealth Management was one of the first few hundred fee-only firms in the U.S. in the late 1980s and has been consistently ranked as one of the top 500 firms in the country by multiple national publications. Under P. J.'s leadership, DiNuzzo Private Wealth, Inc./DiNuzzo Family Office/DiNuzzo Wealth Management, on numerous occasions, has been recognized as one of the "Best Places to Work" and was awarded the honor of "#1 Best Place to Work" in Western Pennsylvania/Pittsburgh in 2008, 2013 and 2016 by the Pittsburgh Business Times. Additionally, P. J. has been awarded the prestigious multi-year designation as a FIVE STAR Wealth Manager. The award is given to wealth managers in Pittsburgh and across the U.S. who satisfy key client criteria and score the highest in overall client satisfaction.

P. J. has earned the distinguished Personal Financial Specialist (PFS™) designation. The American Institute of Certified Public Accountants (AICPA), a national professional organization of CPA professionals grants the PFS credential only to certified public accountants with a significant personal financial planning education and experience. Candidates must meet six necessary requirements including an arduous technical exam and a peer review of their ability to demonstrate significant experience in a wide range of comprehensive personal financial planning disciplines.

P. J. has earned the distinguished Personal Financial Specialist (PFS™) designation. The American Institute of Certified Public Accountants (AICPA), a national professional organization of CPA professionals grants the PFS credential only to certified public accountants with a significant personal financial planning education and experience. Candidates must meet six necessary requirements including an arduous technical exam and a peer review of their ability to demonstrate significant experience in a wide range of comprehensive personal financial planning disciplines.

P. J. has appeared and been interviewed on numerous occasions regarding Strategic Asset Allocation, Portfolio Diversification, Indexing, Rebalancing, and Retirement Income Planning on various Television and Radio programs including: OPRAH & Friends with Jean Chatzky on XM Radio, CNBC- TV Power Lunch, KDKA-TV2 Sunday Business Page with Jon Delano, The Lange Money Hour radio show with Jim Lange, and The Street.com TV.

P. J. has also been interviewed and quoted on a number of occasions regarding Strategic Asset Allocation, Portfolio Diversification, Indexing, Rebalancing, and Retirement Income Planning in various national, regional, and local Magazines including: Kiplinger's Personal Finance Retirement Planning, MarketWatch from Dow Jones, Morningstar, SmartMoney, BusinessWeek, Investment Advisor, Financial Planning, NAPFA Advisor, The Wall Street Transcript, Wealth Management Exchange, Wealth Manager, Bottom Line Personal, and IARFC.

He has also been interviewed and quoted on numerous occasions regarding Strategic Asset Allocation, Portfolio Diversification, Indexing, Rebalancing, and Retirement Income Planning in various national, regional, and local Newspapers including: The Wall Street Journal, Barron's, Reuters, Bankrate.com, CBS News, YAHOO! Finance, Pittsburgh Post–Gazette, U.S. News & World Report, MSN Money, Chicago Sun – Times, FT.com Financial Times, Smart Money Select.com, The Atlanta Journal Constitution, St. Louis Dispatch, Chicago Board Options Exchange, Investment News, Pittsburgh Business Times, The Sharon Herald, The Christian Monitor, The Beaver County Times, Pittsburgh Tribune Review, The Mutual Fund Wire.com, Gulf News – the United Arab Emirates (UAE), TMC.net, Comcast.net Finance, Rydex Investments, Free Real Time.com, Individual.com, Lockheed Federal Credit Union, Invest n Retire, ABC – TV9 WCPO.com, Fort Worth Star Telegram, KYPost.com, Wealth Manager, Jim Prevor's Perishable Pundit, Reading Eagle, The Toledo Blade, Horsesmouth, DemocraticUnderground.com, The Community Investment Network, Daily Herald, Scripps News, The Modesto Bee, Hitched, Prime, El Paso times.com, Paladin Advisor, Advisor Max, Denverpost.com, Oswego Daily News, The Dollar Stretcher, Financial Advisor, The Ledger, Post-Gazette.now, The Columbus Dispatch, Savannah Morning News, and Hampton Roads News Channel.

P. J. is a member of the Financial Planning Association (FPA), Estate Planning Council (EPC) of Pittsburgh, American Institute of Certified Public Accountants (AICPA), and the Pennsylvania Institute of Certified Public Accountants (PICPA), the AICPA's National CPA Financial Planning Insights Panel, The National Association of Tax Professionals (NATP), Financial Educators Network (FEN), and the Pittsburgh Society of Investment Professionals (PSIP).

P. J. chose football in lieu of a Major League Baseball offer from the Houston Astros to play with their Class A Team, as he attended and played football at Indiana University under Head Coach Lee Corso in the "Big Ten" (Bloomington, Indiana) and also at the University of Pittsburgh under Head Coach Jackie Sherrill. He later received his BS in Business Administration from Geneva College in Beaver Falls, PA. His graduate studies culminated in an MBA (Masters in Business Administration) from the Katz Graduate School of Business at the University of Pittsburgh and an MSTx (Masters of Science in Tax Law) from Robert Morris University at the downtown Pittsburgh Campus. P. J. received his Certified Public Accountant (CPA) designation from the State of Delaware.

P. J. was a member of the Investment Committee on the Endowment Board for Valley Care Associates, a non-profit organization providing adult day care, home safety consulting, and physical modifications for the elderly in Allegheny and Beaver Counties. He serves as a Finance Council Board Member for St. Blaise Church; and is a member of the Department of Finance Advisory Board for Robert Morris University. He is a volunteer and supports Habitat for Humanity, Red Door Program for the homeless, and commitment to his churches in Midland and Pittsburgh's Southside. He serves on the Board of Directors and volunteers for The Hope House and The Center, both of which are located in Midland, PA and support the women and youth of the community. He serves on the Board of Directors for Catholic Charities, Diocese of Pittsburgh, and is a member of their Programs Committee (Food, Clothing, Shelter, Healthcare, etc.). He is a lifelong resident of the Pittsburgh and Western Pennsylvania area. He devoted over 12 years to helping and assisting numerous young men in Pittsburgh's inner–city and surrounding areas by supporting and coaching over 1,000 basketball games at the AAU, elementary, middle school, junior high, and high school levels attempting to teach and instill in them teamwork, trust, structure, discipline, and hard work. Professionally, he is a member of the Estate Planning Council of Pittsburgh and The Family Office Club.

The Five Star Wealth Manager award, administered by Crescendo Business Services, LLC (dba Five Star Professional), is based on 10 objective criteria. Eligibility criteria – required: 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively licensed as a registered investment adviser or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by Five Star Professional, the wealth manager has not; A. Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or Five Star Professional's consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through Five Star Professional's consumer complaint process; feedback may not be representative of any one client's experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria – considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers. Award does not evaluate quality of services provided to clients. Once awarded, wealth managers may purchase additional profile ad space or promotional products. The Five Star award is not indicative of the wealth manager's future performance. Wealth managers may or may not use discretion in their practice and therefore may not manage their client's assets. The inclusion of a wealth manager on the Five Star Wealth Manager list should not be construed as an endorsement of the wealth manager by Five Star Professional or this publication. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success, nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by Five Star Professional in the future. For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com. 1,814 Pittsburgh-area wealth managers were considered for the award; 233 (13% of candidates) were named 2021 Five Star Wealth Managers. 2020: 1,886 considered, 224 winners; 2019: 1,667 considered, 251 winner; 2018: 1,653 considered, 227 winners; 2017: 1,133 considered, 277 winners; 2016: 1,064 considered, 423 winners; 2015: 1,494 considered, 442 winners; 2014: 1,721 considered, 458 winners; 2013: 1,777 considered, 545 winners; 2012: 1,863 considered, 493 winners.

Mark S. DiNuzzo

CFP®, ChFC®, AIF®, MBA

EVP, Principal, Financial Wellness LifeCoach, Risk Management Team Leader

Phone: 724.728.6564

Toll Free: 877.728.6564

E-mail: mdinuzzo@dinuzzo.com

Mark S. DiNuzzo is the Executive Vice President, Principal, and Risk Management Team Leader of DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management which has operated as an SEC Registered Investment Advisor since 1989 and currently manages $929 million in assets under management as of December 31, 2021. Mark joined the firm in 1997 to lead the expansion of the firms: Client Services Department, Risk Management/Insurance Planning and Financial Planning Department. Mark was a key component in DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management being awarded the "#1 Best Places to Work" in Western Pennsylvania/Pittsburgh in 2008, 2013 and 2016 by the Pittsburgh Business Times. Additionally, Mark has been awarded the prestigious multi-year designation as a FIVE STAR Wealth Manager. The award is given to wealth managers in Pittsburgh and across the U.S. who satisfy key client criteria and score the highest in overall client satisfaction.

Mark has earned the prestigious CERTIFIED FINANCIAL PLANNER™ professional CFP® designation granted by the Certified Financial Planner Board of Standards, Inc. since 2004. The CFP® certification is a voluntary certification; no federal or state law or regulation requires financial planners to hold CFP® certification. It is recognized in the United States and a number of other countries for its (1) high standard of professional education; (2) stringent code of conduct and standards of practice; and (3) ethical requirements that govern professional engagements with clients. In addition to completing the demanding requirements to become a CERTIFIED FINANCIAL PLANNER™ professional, Mark also has an MBA (Masters in Business Administration).

Mark has earned the prestigious CERTIFIED FINANCIAL PLANNER™ professional CFP® designation granted by the Certified Financial Planner Board of Standards, Inc. since 2004. The CFP® certification is a voluntary certification; no federal or state law or regulation requires financial planners to hold CFP® certification. It is recognized in the United States and a number of other countries for its (1) high standard of professional education; (2) stringent code of conduct and standards of practice; and (3) ethical requirements that govern professional engagements with clients. In addition to completing the demanding requirements to become a CERTIFIED FINANCIAL PLANNER™ professional, Mark also has an MBA (Masters in Business Administration).

In May 2013, Mark was awarded the Accredited Investment Fiduciary® (AIF®) designation from the Center for Fiduciary Studies™, the standards-setting body for fi360. The AIF® designation certifies that the recipient has specialized knowledge of fiduciary standards of care and their application to the investment management process. The AIF® designation includes an agreement to abide by the AIF Code of Ethics. In order to maintain the AIF® designation, the individual must annually renew their affirmation of the AIF Code of Ethics and complete continuing education credits.

In 2013, Mark was nominated and approved as a member of the Board of Directors for the Beaver County Cancer & Heart Association Board. Mark is also a member of the Financial Planning Association (FPA); the Estate Planning Council of Pittsburgh (EPC); and on November 1, 2014 Mark achieved his Chartered Financial Consultant® (ChFC®) designation through The American College of Financial Services.

Mark attended and played football at California University of Pennsylvania "Cal U" under Head Coach Hal Hunter. He later achieved his BS in Business Administration from Geneva College in Beaver Falls, PA. His graduate studies culminated in an MBA (Masters in Business Administration) from the Graduate School of Business at Robert Morris University.

A lifelong resident of Western Pennsylvania, Mark devotes his free time to his church where he serves as a Eucharistic Minister. Mark also has taught CCD Classes throughout every Saturday of the school year for over 20 years. He has also served the community as a youth baseball and basketball coach. Mark has three sons and daughter-in-law, Matt, Tony (Eleanor), and Chris and resides in Brighton Township, PA with his wife, Jackie.

The Five Star Wealth Manager award, administered by Crescendo Business Services, LLC (dba Five Star Professional), is based on 10 objective criteria. Eligibility criteria – required: 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively licensed as a registered investment adviser or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by Five Star Professional, the wealth manager has not; A. Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or Five Star Professional's consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through Five Star Professional's consumer complaint process; feedback may not be representative of any one client's experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria – considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers. Award does not evaluate quality of services provided to clients. Once awarded, wealth managers may purchase additional profile ad space or promotional products. The Five Star award is not indicative of the wealth manager's future performance. Wealth managers may or may not use discretion in their practice and therefore may not manage their client's assets. The inclusion of a wealth manager on the Five Star Wealth Manager list should not be construed as an endorsement of the wealth manager by Five Star Professional or this publication. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success, nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by Five Star Professional in the future. For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com. 1,814 Pittsburgh-area wealth managers were considered for the award; 233 (13% of candidates) were named 2021 Five Star Wealth Managers. 2020: 1,886 considered, 224 winners; 2019: 1,667 considered, 251 winner; 2018: 1,653 considered, 227 winners; 2017: 1,133 considered, 277 winners; 2016: 1,064 considered, 423 winners; 2015: 1,494 considered, 442 winners; 2014: 1,721 considered, 458 winners; 2013: 1,777 considered, 545 winners; 2012: 1,863 considered, 493 winners.

The Five Star Wealth Manager award, administered by Crescendo Business Services, LLC (dba Five Star Professional), is based on 10 objective criteria. Eligibility criteria – required: 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively licensed as a registered investment adviser or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by Five Star Professional, the wealth manager has not; A. Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or Five Star Professional's consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through Five Star Professional's consumer complaint process; feedback may not be representative of any one client's experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria – considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers. Award does not evaluate quality of services provided to clients. Once awarded, wealth managers may purchase additional profile ad space or promotional products. The Five Star award is not indicative of the wealth manager's future performance. Wealth managers may or may not use discretion in their practice and therefore may not manage their client's assets. The inclusion of a wealth manager on the Five Star Wealth Manager list should not be construed as an endorsement of the wealth manager by Five Star Professional or this publication. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success, nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by Five Star Professional in the future. For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com. 1,814 Pittsburgh-area wealth managers were considered for the award; 233 (13% of candidates) were named 2021 Five Star Wealth Managers. 2020: 1,886 considered, 224 winners; 2019: 1,667 considered, 251 winner; 2018: 1,653 considered, 227 winners; 2017: 1,133 considered, 277 winners; 2016: 1,064 considered, 423 winners; 2015: 1,494 considered, 442 winners; 2014: 1,721 considered, 458 winners; 2013: 1,777 considered, 545 winners; 2012: 1,863 considered, 493 winners.

Carl J. Hartman

ChFC®, AIF®

SVP, Principal, Financial Wellness LifeCoach, Sr. Investment Officer

Phone: 724.728.6564

Toll Free: 877.728.6564

E-mail: chartman@dinuzzo.com

Carl J. Hartman is the Senior Vice President, Principal, and Senior Investment Officer of DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management which has operated as an SEC Registered Investment Advisor since 1989 and currently manages $929 million in assets under management as of December 31, 2021. Carl joined the firm in 2007 with the objective of joining a "Fee Only" Wealth Management Firm that was focused on offering their clients sound objective investment and financial planning under a fiduciary standard. Carl was a key component in DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management, being awarded the "#1 Best Places to Work" in Western Pennsylvania/Pittsburgh in 2008, 2013 and 2016 by the Pittsburgh Business Times. Additionally, Carl has been awarded the prestigious multi-year designation as a FIVE STAR Wealth Manager. The award is given to wealth managers in Pittsburgh and across the U.S. who satisfy key client criteria and score the highest in overall client satisfaction.

He has been a licensed representative in the investment field for the past 20+ years. He was previously employed by Charles Schwab & Co. Inc., where he was assigned to handle many service and investment related issues with a diverse client base of over 400 clients. He worked side by side with the Schwab Private Client and Advised Investing Team in helping his clients with their asset management and financial planning issues.

Carl has devoted his talents at DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management to Institutional Style Index Investment Management, Financial Planning and Business Development; he has perfected his communication skills to convey our business philosophy to prospective clients. His vast experience in the financial planning segment allows prospective clients an additional benefit when researching individual investment firms. Carl's clear, concise approach to business development and our mission has added value to our firm and clients. His sincere belief in the primary objective at DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management of addressing the clients' planning needs, objectives and goals is a perfect fit for the firm.

Carl has devoted his talents at DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management to Institutional Style Index Investment Management, Financial Planning and Business Development; he has perfected his communication skills to convey our business philosophy to prospective clients. His vast experience in the financial planning segment allows prospective clients an additional benefit when researching individual investment firms. Carl's clear, concise approach to business development and our mission has added value to our firm and clients. His sincere belief in the primary objective at DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management of addressing the clients' planning needs, objectives and goals is a perfect fit for the firm.

Carl earned a Bachelor of Science Degree (BS) in Business Administration from Duquesne University and a Private Pilot Certificate from Kent State University. Carl is a member of the Financial Planning Association (FPA). Carl has also completed the comprehensive and in-depth Professional Advancement program and classes at Duquesne University and achieved their Executive Certificate in Financial Planning designation. In 2014, Carl achieved his Chartered Financial Consultant® (ChFC®) designation through The American College of Financial Services; and became a member of The Pittsburgh Society of Investment Professionals (PSIP).

Also in 2014, Carl was awarded the Accredited Investment Fiduciary® (AIF®) Designation from the Center for Fiduciary Studies™, the standards-setting body for fi360. The AIF® designation certifies that the recipient has specialized knowledge of fiduciary standards of care and their application to the investment management process. The AIF® designation includes an agreement to abide by the AIF Code of Ethics. In order to maintain the AIF® designation, the individual must annually renew their affirmation of the AIF Code of Ethics and complete continuing education credits.

He is a lifelong resident of the Mon Valley Area of Pittsburgh where he and his wife currently reside. In his time away from work, he and his wife enjoy quality time together with their adult children, family and friends. Carl is an avid exercise/workout enthusiast and also enjoys golfing and boating.

The Five Star Wealth Manager award, administered by Crescendo Business Services, LLC (dba Five Star Professional), is based on 10 objective criteria. Eligibility criteria – required: 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively licensed as a registered investment adviser or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by Five Star Professional, the wealth manager has not; A. Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or Five Star Professional's consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through Five Star Professional's consumer complaint process; feedback may not be representative of any one client's experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria – considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers. Award does not evaluate quality of services provided to clients. Once awarded, wealth managers may purchase additional profile ad space or promotional products. The Five Star award is not indicative of the wealth manager's future performance. Wealth managers may or may not use discretion in their practice and therefore may not manage their client's assets. The inclusion of a wealth manager on the Five Star Wealth Manager list should not be construed as an endorsement of the wealth manager by Five Star Professional or this publication. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success, nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by Five Star Professional in the future. For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com. 1,814 Pittsburgh-area wealth managers were considered for the award; 233 (13% of candidates) were named 2021 Five Star Wealth Managers. 2020: 1,886 considered, 224 winners; 2019: 1,667 considered, 251 winner; 2018: 1,653 considered, 227 winners; 2017: 1,133 considered, 277 winners; 2016: 1,064 considered, 423 winners; 2015: 1,494 considered, 442 winners; 2014: 1,721 considered, 458 winners; 2013: 1,777 considered, 545 winners; 2012: 1,863 considered, 493 winners.

Michael V. DiNuzzo

CFP®, ChFC®, AIF®, MSFP

SVP, Principal, Financial Wellness LifeCoach, Risk Management Team Leader

Phone: 724.728.6564

Toll Free: 877.728.6564

E-mail: mvdinuzzo@dinuzzo.com

Michael V. DiNuzzo is the Senior Vice President (SVP), Principal, and Risk Management Team Leader of DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management which has operated as an SEC Registered Investment Advisor since 1989 and currently manages $929 million in assets under management as of December 31, 2021. Michael (Mike) joined DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management in 2007 serving in the Financial Planning department as an intern until 2010 when he joined the firm full-time and was promoted to Financial Wellness LifeCoach. Mike was a key component in DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management being awarded the “#1 Best Places to Work” in Western Pennsylvania/Pittsburgh in 2008, 2013 and 2016 by the Pittsburgh Business Times. Additionally, Mike has been awarded the prestigious multi-year designation as a FIVE STAR Wealth Manager. The award is given to wealth managers in Pittsburgh and across the U.S. who satisfy key client criteria and score the highest in overall client satisfaction.

Mike’s objective was to join a firm that uses a ‘team’ approach in making recommendations to solve for what lies in the best interest of its clients. Mike firmly believes that investment philosophy, world class research, disciplined asset allocation models, and especially fiduciary responsibility are necessary for a successful client relationship. Mike continuously demonstrates the critical elements for client satisfaction and success in the fields of Wealth and Risk Management.

Mike’s objective was to join a firm that uses a ‘team’ approach in making recommendations to solve for what lies in the best interest of its clients. Mike firmly believes that investment philosophy, world class research, disciplined asset allocation models, and especially fiduciary responsibility are necessary for a successful client relationship. Mike continuously demonstrates the critical elements for client satisfaction and success in the fields of Wealth and Risk Management.

Mike received his BA (Bachelor of Arts Degree) from Duquesne University and is a member of the Duquesne University Alumni Association. In 2016, Mike successfully completed his Master of Science Degree in Financial Planning (MSFP) from Bentley University in Boston, MA. Mike is a member of the Financial Planning Association (FPA). In addition, Mike has held his Chartered Financial Consultant® (ChFC®) designation through The American College of Financial Services since 2013.

Mike earned the prestigious CERTIFIED FINANCIAL PLANNER™ professional CFP® designation granted by the Certified Financial Planner Board of Standards, Inc. in 2013. The CFP® certification is a voluntary certification; no federal or state law or regulation requires financial planners to hold CFP® certification. It is recognized in the United States and a number of other countries for its (1) high standard of professional education; (2) stringent code of conduct and standards of practice; and (3) ethical requirements that govern professional engagements with clients.

In 2014, Mike was awarded the Accredited Investment Fiduciary® (AIF®) Designation from the Center for Fiduciary Studies™, the standards-setting body for fi360. The AIF® designation certifies that the recipient has specialized knowledge of fiduciary standards of care and their application to the investment management process. The AIF® designation includes an agreement to abide by the AIF Code of Ethics. In order to maintain the AIF® designation, the individual must annually renew their affirmation of the AIF Code of Ethics and complete continuing education credits.

Mike has been interviewed and quoted in the U.S. News & World Report and The Huffington Post (both articles may be accessed on our website under "In the News"), as well as, USA Today, Yahoo! News, MarketWatch, Investor's Business Daily and Bankrate.

Mike was born and raised in Beaver, PA. He currently resides in Ben Avon Heights with his wife, Jessica, and their daughter, Estelle. He is active in his church and community, and considers himself a lifelong learner committed to living a healthy and positive lifestyle.

The Five Star Wealth Manager award, administered by Crescendo Business Services, LLC (dba Five Star Professional), is based on 10 objective criteria. Eligibility criteria – required: 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively licensed as a registered investment adviser or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by Five Star Professional, the wealth manager has not; A. Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or Five Star Professional’s consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through Five Star Professional’s consumer complaint process; feedback may not be representative of any one client’s experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria – considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers. Award does not evaluate quality of services provided to clients. Once awarded, wealth managers may purchase additional profile ad space or promotional products. The Five Star award is not indicative of the wealth manager’s future performance. Wealth managers may or may not use discretion in their practice and therefore may not manage their client’s assets. The inclusion of a wealth manager on the Five Star Wealth Manager list should not be construed as an endorsement of the wealth manager by Five Star Professional or this publication. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success, nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by Five Star Professional in the future. For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com. 1,814 Pittsburgh-area wealth managers were considered for the award; 233 (13% of candidates) were named 2021 Five Star Wealth Managers. 2020: 1,886 considered, 224 winners; 2019: 1,667 considered, 251 winner; 2018: 1,653 considered, 227 winners; 2017: 1,133 considered, 277 winners; 2016: 1,064 considered, 423 winners; 2015: 1,494 considered, 442 winners; 2014: 1,721 considered, 458 winners; 2013: 1,777 considered, 545 winners; 2012: 1,863 considered, 493 winners.

The Five Star Wealth Manager award, administered by Crescendo Business Services, LLC (dba Five Star Professional), is based on 10 objective criteria. Eligibility criteria – required: 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively licensed as a registered investment adviser or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by Five Star Professional, the wealth manager has not; A. Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or Five Star Professional’s consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through Five Star Professional’s consumer complaint process; feedback may not be representative of any one client’s experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria – considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers. Award does not evaluate quality of services provided to clients. Once awarded, wealth managers may purchase additional profile ad space or promotional products. The Five Star award is not indicative of the wealth manager’s future performance. Wealth managers may or may not use discretion in their practice and therefore may not manage their client’s assets. The inclusion of a wealth manager on the Five Star Wealth Manager list should not be construed as an endorsement of the wealth manager by Five Star Professional or this publication. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success, nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by Five Star Professional in the future. For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com. 1,814 Pittsburgh-area wealth managers were considered for the award; 233 (13% of candidates) were named 2021 Five Star Wealth Managers. 2020: 1,886 considered, 224 winners; 2019: 1,667 considered, 251 winner; 2018: 1,653 considered, 227 winners; 2017: 1,133 considered, 277 winners; 2016: 1,064 considered, 423 winners; 2015: 1,494 considered, 442 winners; 2014: 1,721 considered, 458 winners; 2013: 1,777 considered, 545 winners; 2012: 1,863 considered, 493 winners.

Robert F. Graham

AIF®, MBA

VP, Financial Wellness LifeCoach

Phone: 724.728.6564

Toll Free: 877.728.6564

E-mail: rgraham@dinuzzo.com

Robert F. Graham is a Vice President and Financial Wellness LifeCoach at DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management which has operated as an SEC Registered Investment Advisory Firm since 1989 and currently manages $929 million in assets under management as of December 31, 2021. Robert (Bob) joined the firm in 2016, with the objective of joining a "Fee Only" Wealth Management Firm that was focused on offering their clients sound, objective investment and financial planning under a fiduciary standard. Bob was a key component in DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management being awarded the “#1 Best Places to Work” in Western Pennsylvania/Pittsburgh in 2016 by the Pittsburgh Business Times. Additionally, Bob has been awarded the prestigious multi-year designation as a FIVE STAR Wealth Manager. The award is given to wealth managers in Pittsburgh and across the U.S. who satisfy key client criteria and score the highest in overall client satisfaction.

Bob has been a licensed representative in financial services for over 27 years. His experience includes 20 years at Charles Schwab, where he focused on the many service and investment related issues with a diverse client base of over 350 clients. He worked closely with the Schwab Private Client and Advised Investing Team in implementing his clients’ asset management strategies and financial plans. He also served as a branch manager at Charles Schwab for several years. His professional experience also includes stints at TD Ameritrade and PNC Investments.

Bob has been a licensed representative in financial services for over 27 years. His experience includes 20 years at Charles Schwab, where he focused on the many service and investment related issues with a diverse client base of over 350 clients. He worked closely with the Schwab Private Client and Advised Investing Team in implementing his clients’ asset management strategies and financial plans. He also served as a branch manager at Charles Schwab for several years. His professional experience also includes stints at TD Ameritrade and PNC Investments.

Bob’s broad experience in financial planning and wealth management allows prospective clients an additional benefit when researching individual investment firms, and his real world experience adds significant value to our firm and clients. His steadfast belief in placing primary emphasis on addressing his clients' planning needs, objectives and goals above all exemplifies the DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management approach. Bob is a member in the Financial Planning Association (FPA).

Bob earned a BS (Bachelor of Science) Degree in Civil Engineering from Catholic University in Washington, D.C., and a Master of Business Administration (MBA) degree from Mount St. Mary’s University in Maryland.

In 2016, Bob was awarded the Accredited Investment Fiduciary® (AIF®) Designation from the Center for Fiduciary Studies™, the standards-setting body for fi360. The AIF® designation certifies that the recipient has specialized knowledge of fiduciary standards of care and their application to the investment management process. The AIF® designation includes an agreement to abide by the AIF Code of Ethics. In order to maintain the AIF® designation, the individual must annually renew their affirmation of the AIF Code of Ethics and complete continuing education credits.

Bob was raised in the Washington, D.C. area and moved to Pittsburgh over 25 years ago. He lives with his wife and daughter in the Squirrel Hill area of Pittsburgh, and in his time away from work he and his family enjoy the city’s parks, entertainment, and cultural benefits. Bob is a sports enthusiast and enjoys golf, skiing and biking.

The Five Star Wealth Manager award, administered by Crescendo Business Services, LLC (dba Five Star Professional), is based on 10 objective criteria. Eligibility criteria – required: 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively licensed as a registered investment adviser or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by Five Star Professional, the wealth manager has not; A. Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or Five Star Professional’s consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through Five Star Professional’s consumer complaint process; feedback may not be representative of any one client’s experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria – considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers. Award does not evaluate quality of services provided to clients. Once awarded, wealth managers may purchase additional profile ad space or promotional products. The Five Star award is not indicative of the wealth manager’s future performance. Wealth managers may or may not use discretion in their practice and therefore may not manage their client’s assets. The inclusion of a wealth manager on the Five Star Wealth Manager list should not be construed as an endorsement of the wealth manager by Five Star Professional or this publication. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success, nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by Five Star Professional in the future. For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com. 1,814 Pittsburgh-area wealth managers were considered for the award; 233 (13% of candidates) were named 2021 Five Star Wealth Managers. 2020: 1,886 considered, 224 winners; 2019: 1,667 considered, 251 winner; 2018: 1,653 considered, 227 winners; 2017: 1,133 considered, 277 winners; 2016: 1,064 considered, 423 winners; 2015: 1,494 considered, 442 winners; 2014: 1,721 considered, 458 winners; 2013: 1,777 considered, 545 winners; 2012: 1,863 considered, 493 winners.

Jacob R. Potts

CFP®, ChFC®, AIF®

VP, Financial Wellness LifeCoach, Trade Team Leader

Phone: 724.728.6564

Toll Free: 877.728.6564

E-mail: jpotts@dinuzzo.com

Jacob R. Potts is a Vice President and Financial Wellness LifeCoach at DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management which has operated as an SEC Registered Investment Advisory Firm since 1989 and currently manages $929 million in assets under management since December 31, 2021. Jacob became associated with the firm in 2012 when he job shadowed for his senior project. He was an intern for the firm while attending Robert Morris University; and in December 2015, joined the firm full-time as Client Service Advisor. In August 2016, he became a Financial Wellness LifeCoach and shortly thereafter in January 2017, achieved the position of Portfolio Management Team Manager (Trade Team Leader). Jacob was a key component in DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management being awarded the “#1 Best Places to Work” in Western Pennsylvania/Pittsburgh in 2016 by the Pittsburgh Business Times.

Jacob is a graduate of Robert Morris University and received a Bachelor of Science in Business Administration (BSBA) degree in finance graduating Magna Cum Laude. Jacob is a member of the Financial Planning Association (FPA).

Jacob earned the prestigious CERTIFIED FINANCIAL PLANNER™ professional CFP® designation granted by the Certified Financial Planner Board of Standards, Inc. in August 2019. The CFP® certification is a voluntary certification; no federal or state law or regulation requires financial planners to hold CFP® certification. It is recognized in the United States and a number of other countries for its (1) high standard of professional education; (2) stringent code of conduct and standards of practice; and (3) ethical requirements that govern professional engagements with clients.

Jacob achieved his Chartered Financial Consultant® or ChFC® designation through The American College of Financial Services in April 2019.

Also in April 2019, Jacob was awarded the Accredited Investment Fiduciary® (AIF®) designation from the Center for Fiduciary Studies™, the standards-setting body for fi360. The AIF® designation certifies that the recipient has specialized knowledge of fiduciary standards of care and their application to the investment management process. The AIF® designation includes an agreement to abide by the AIF Code of Ethics. In order to maintain the AIF® designation, the individual must annually renew their affirmation of the AIF Code of Ethics and complete continuing education credits.

Prior to joining DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management, Jacob worked for ESB Bank as a Client Service Representative processing account transactions.

Jacob was born and raised in New Brighton, PA and maintains a busy lifestyle by being a PIAA official umpiring baseball games, bodybuilding, hiking, and golfing when weather permits.

Jacob was born and raised in New Brighton, PA and maintains a busy lifestyle by being a PIAA official umpiring baseball games, bodybuilding, hiking, and golfing when weather permits.

Leslie D. Taylor-Neumann

CFP®, ChFC®, AIF®

VP, Financial Wellness LifeCoach, Wealth Planning Team Leader

Phone: 724.728.6564

Toll Free: 877.728.6564

E-mail: ltaylor-neumann@dinuzzo.com

Leslie D. Taylor-Neumann has been a Financial Wellness LifeCoach since July of 2017 at DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management which has operated as an SEC Registered Investment Advisory firm since 1989 and currently manages $929 million in assets under management as of December 31, 2021. Leslie joined the DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management team as an intern in May of 2015. In June of 2016, she was hired full-time as a Client Service Advisor, and in July of 2017 Leslie earned the Financial Wellness LifeCoach position. Leslie currently has the role of Wealth Planning Team Leader and assists our Financial Wellness LifeCoaches in building each of their client’s DiNuzzo Financial Wellness LifePlan™.

In 2016, Leslie graduated from Robert Morris University (RMU) with a Bachelor of Science in Business Administration degree in Finance. At RMU, she was the President of the Financial Management Association and the Outdoor Adventure Club. During her senior year, she served as a mentor for freshman in the RMU Adventure Program. Leslie is a member of the Financial Planning Association (FPA).

Leslie earned the prestigious CERTIFIED FINANCIAL PLANNER™ professional CFP® designation granted by the Certified Financial Planner Board of Standards, Inc. in April 2021. The CFP® certification is a voluntary certification; no federal or state law or regulation requires financial planners to hold CFP® certification. It is recognized in the United States and a number of other countries for its (1) high standard of professional education; (2) stringent code of conduct and standards of practice; and (3) ethical requirements that govern professional engagements with clients.

Leslie achieved her Chartered Financial Consultant® or ChFC® designation through The American College of Financial Services in September 2020.

Additionally, in December 2020, Leslie was awarded the Accredited Investment Fiduciary® (AIF®) designation from the Center for Fiduciary Studies™, the standards-setting body for fi360. The AIF® designation certifies that the recipient has specialized knowledge of fiduciary standards of care and their application to the investment management process. The AIF® designation includes an agreement to abide by the AIF Code of Ethics. In order to maintain the AIF® designation, the individual must annually renew their affirmation of the AIF Code of Ethics and complete continuing education credits.

Prior to joining DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management, Leslie worked as a staff manager, photographer and cashier for World Wide Photography. She also worked as an Administrative Assistant for the Union Rescue Mission, a non-profit homeless shelter.

Leslie was born in Cumberland, Maryland and was raised in Bedford, Pennsylvania. She spends her free time practicing yoga, snowboarding and enjoying outdoor sports with her husband, Daniel. Leslie and Daniel were married in December of 2017, they reside in Cumberland, Maryland. Leslie states her family as her biggest support system.

Jennifer B. Reddinger

CFP®, AIF®, CDFA®, AAMS®

VP, Financial Wellness LifeCoach, Tax Team Co-Leader

Phone: 724.728.6564

Toll Free: 877.728.6564

E-mail: jreddinger@dinuzzo.com

Jennifer B. Reddinger is a Vice President and Financial Wellness LifeCoach at DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management which has operated as an SEC Registered Investment Advisory firm since 1989 and currently manages $929 million in assets under management as of December 31, 2021. Jennifer joined the firm in April of 2019, with the objective of joining a “Fee Only” Wealth Management firm that was focused on offering their clients sound, objective investment and DiNuzzo Financial Wellness LifePlan™ under a fiduciary standard. Jennifer is now a Tax Team Co-Leader assisting in Wealth Planning; and in 2020, she was awarded the prestigious designation as a FIVE STAR Wealth Manager. The award is given to wealth managers in Pittsburgh and across the U.S. who satisfy key client criteria and score the highest in overall client satisfaction.

Jennifer joined DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management with over 16 years of experience in the financial advising industry servicing a variety of different client needs. Early in her career, she recognized the importance of industry education and began to expand her knowledge by obtaining several designations including the Accredited Asset Management Specialist (AAMS®), CERTIFIED FINANCIAL PLANNER™ (CFP®), and Certified Divorce Financial Analyst (CDFA®). Being a lifetime equestrian, she also designated time to becoming an Equine Appraiser helping her understand exactly how to incorporate equines into client’s financial lives. Jennifer received a Bachelor of Science in Kinesiology from Penn State.

Jennifer joined DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management with over 16 years of experience in the financial advising industry servicing a variety of different client needs. Early in her career, she recognized the importance of industry education and began to expand her knowledge by obtaining several designations including the Accredited Asset Management Specialist (AAMS®), CERTIFIED FINANCIAL PLANNER™ (CFP®), and Certified Divorce Financial Analyst (CDFA®). Being a lifetime equestrian, she also designated time to becoming an Equine Appraiser helping her understand exactly how to incorporate equines into client’s financial lives. Jennifer received a Bachelor of Science in Kinesiology from Penn State.

Jennifer has earned the prestigious CERTIFIED FINANCIAL PLANNER™ professional CFP® designation granted by the Certified Financial Planner Board of Standards, Inc. in 2009. The CFP® certification is a voluntary certification; no federal or state law or regulation requires financial planners to hold CFP® certification. It is recognized in the United States and a number of other countries for its (1) high standard of professional education; (2) stringent code of conduct and standards of practice; and (3) ethical requirements that govern professional engagements with clients.

In 2019, Jennifer was awarded the Accredited Investment Fiduciary® (AIF®) designation from the Center for Fiduciary Studies™, the standards-setting body for fi360. The AIF® designation certifies that the recipient has specialized knowledge of fiduciary standards of care and their application to the investment management process. The AIF® designation includes an agreement to abide by the AIF Code of Ethics. In order to maintain the AIF® designation, the individual must annually renew their affirmation of the AIF Code of Ethics and complete continuing education credits.

Jennifer specializes in financial transitions. She believes holistic financial planning from the beginning of every relationship will help clients achieve optimal financial wellness. Jennifer utilizes a strong team approach when planning for clients. The relationships she has maintained over the years has helped enhance her clients’ financial lives. A holistic financial planning approach combined with a team atmosphere has helped Jennifer maintain a fiduciary title since 2012.

Jennifer was born and raised in Western Pennsylvania, and she currently resides in Beaver with her two young children. Together, they snow ski, ride horses and participate in local running programs. Jennifer has been active in several charitable organizations, including but not limited to, the Cinderella Women’s Committee, Bright Futures Farm, the YMCA, and The MoneyCulture Initiative.

The Five Star Wealth Manager award, administered by Crescendo Business Services, LLC (dba Five Star Professional), is based on 10 objective criteria. Eligibility criteria – required: 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively licensed as a registered investment adviser or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by Five Star Professional, the wealth manager has not; A. Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or Five Star Professional’s consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through Five Star Professional’s consumer complaint process; feedback may not be representative of any one client’s experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria – considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers. Award does not evaluate quality of services provided to clients. Once awarded, wealth managers may purchase additional profile ad space or promotional products. The Five Star award is not indicative of the wealth manager’s future performance. Wealth managers may or may not use discretion in their practice and therefore may not manage their client’s assets. The inclusion of a wealth manager on the Five Star Wealth Manager list should not be construed as an endorsement of the wealth manager by Five Star Professional or this publication. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success, nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by Five Star Professional in the future. For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com. 1,814 Pittsburgh-area wealth managers were considered for the award; 233 (13% of candidates) were named 2021 Five Star Wealth Managers. 2020: 1,886 considered, 224 winners; 2019: 1,667 considered, 251 winner; 2018: 1,653 considered, 227 winners; 2017: 1,133 considered, 277 winners; 2016: 1,064 considered, 423 winners; 2015: 1,494 considered, 442 winners; 2014: 1,721 considered, 458 winners; 2013: 1,777 considered, 545 winners; 2012: 1,863 considered, 493 winners.

The Five Star Wealth Manager award, administered by Crescendo Business Services, LLC (dba Five Star Professional), is based on 10 objective criteria. Eligibility criteria – required: 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively licensed as a registered investment adviser or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by Five Star Professional, the wealth manager has not; A. Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or Five Star Professional’s consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through Five Star Professional’s consumer complaint process; feedback may not be representative of any one client’s experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria – considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers. Award does not evaluate quality of services provided to clients. Once awarded, wealth managers may purchase additional profile ad space or promotional products. The Five Star award is not indicative of the wealth manager’s future performance. Wealth managers may or may not use discretion in their practice and therefore may not manage their client’s assets. The inclusion of a wealth manager on the Five Star Wealth Manager list should not be construed as an endorsement of the wealth manager by Five Star Professional or this publication. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success, nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by Five Star Professional in the future. For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com. 1,814 Pittsburgh-area wealth managers were considered for the award; 233 (13% of candidates) were named 2021 Five Star Wealth Managers. 2020: 1,886 considered, 224 winners; 2019: 1,667 considered, 251 winner; 2018: 1,653 considered, 227 winners; 2017: 1,133 considered, 277 winners; 2016: 1,064 considered, 423 winners; 2015: 1,494 considered, 442 winners; 2014: 1,721 considered, 458 winners; 2013: 1,777 considered, 545 winners; 2012: 1,863 considered, 493 winners.

Kenneth M. McDaniel

EA, AIF®, MS

VP, Financial Wellness LifeCoach, Tax Team Leader

Phone: 724.728.6564

Toll Free: 877.728.6564

E-mail: kmcdaniel@dinuzzo.com

Kenneth M. McDaniel is an Enrolled Agent (EA), Tax Team Leader, and Financial Wellness LifeCoach at DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management which has operated as an SEC Registered Investment Advisory firm since 1989 and currently manages $929 million in assets under management as of December 31, 2021. Ken joined the firm in October of 2019, with the objective of joining a “Fee Only” Wealth Management firm that was focused on offering their clients sound, objective investment, DiNuzzo Financial Wellness LifePlan™ and tax planning under a fiduciary standard. In February of 2020, Kenneth became certified as a Financial Wellness LifeCoach.

An Enrolled Agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual or business tax returns, or through experience as a former IRS employee. Enrolled agent status is the highest credential the IRS awards. Individuals who obtain this elite status must adhere to ethical standards and complete 72 hours of continuing education courses every three years.

Enrolled agents, like attorneys and certified public accountants (CPAs), have unlimited practice rights. This means they are unrestricted as to which taxpayers they can represent, what types of tax matters they can handle, and which IRS offices they can represent clients before. Learn more about enrolled agents in Treasury Department Circular 230 (PDF).

In February 2021, Ken was awarded the Accredited Investment Fiduciary® (AIF®) designation from the Center for Fiduciary Studies™, the standards-setting body for fi360. The AIF® designation certifies that the recipient has specialized knowledge of fiduciary standards of care and their application to the investment management process. The AIF® designation includes an agreement to abide by the AIF Code of Ethics. In order to maintain the AIF® designation, the individual must annually renew their affirmation of the AIF Code of Ethics and complete continuing education credits.

Ken brings 30+ years of leadership experience in his background. Along with his Enrolled Agent designation, Ken has completed his Accounting Studies at the College of DuPage, qualifying him to sit for the Certified Public Accountancy, (CPA) examinations. Ken also has earned an Undergraduate Bachelor of Arts from Lewis University and a Master of Science (MS) from Duquesne University.

Ken resides in Center Township with his spouse Marie. In his spare time Ken is a Patched PIAA baseball umpire and participates in umpiring baseball games. Ken also volunteers with the Diocese of Pittsburgh, is a physical fitness enthusiast and enjoys the challenge of 5k runs.

Phyllis M. Nutz (DiNuzzo)

Matriarch Emeritus

Phone: 724.728.6564

Toll Free: 877.728.6564

Phyllis is not only the matriarch of the Nutz/DiNuzzo family, but she also holds the title of Matriarch Emeritus here at DiNuzzo Private Wealth, Inc. (DPW).

Throughout the 30+ years that DPW has operated, Phyllis has been the face of our business and what we represent to our “family” of clients; setting the standard for our client service. She worked tirelessly and unselfishly sacrificed to help make DPW the success that it is today; reminding us along the way that even the toughest challenges we face are not so bad when we work together and don’t forget to smile and laugh.

She has been an inspiration to the entire team at DPW, but especially to the woman at DPW. Modeling strong leadership with grace, she remained a driving force in spite of losing her business partner and husband early in her adult life, never steering far from her cheerful disposition and always displaying her compassion for others through her fun-loving and engaging personality.

Phyllis was born in Wheeling, WV and raised in Aliquippa, PA. She had over 46 years of business experience, primarily in the banking, service and financial industries.

Phyllis’ hobbies were many including reading, knitting, crocheting, and quilting. She remains extremely proud of her two sons, grandsons and great-grandchildren. She has been a lifelong active member in her church and numerous charitable organizations. She currently resides in Midland, PA.

Jackie M. DiNuzzo

Senior Compliance Officer, Human Resource Manager

Phone: 724.728.6564

Toll Free: 877.728.6564

E-mail: jdinuzzo@dinuzzo.com

Jackie was born and raised in North Huntingdon, PA. She has extensive customer service and human resource experience with Fortune 500 organizations. Jackie attended Community College of Westmoreland County and Robert Morris University.

Jackie provides direct support to the Chief Compliance Officer as well as working in the Human Resources and Billing areas of the office.

Jackie and her husband, Mark, reside in Brighton Township in Beaver County, and have three grown sons and one daughter-in-law.

Terri S. Tepsic

Executive Assistant

Phone: 724.728.6564

Toll Free: 877.728.6564

E-mail: ttepsic@dinuzzo.com

Terri joined DiNuzzo Private Wealth, Inc./DiNuzzo Wealth Management in January of 2007. She is a 1992 Honor Graduate from Community College of Beaver County with an Associate Degree in Business Management. Terri also has over 20 years of experience in the restaurant, human resource and business sectors.

She was born and raised in the Beaver County area, and resided in Boardman, Ohio from 1993-2008. In 2008, she moved back to Beaver County to take care of her then elderly mother and father.

Terri has three children: Charles, Lori Beth and Nicole; and eight grandchildren: Joey, Cody, Isaac, Hunter, Ayden, Austin, Lexi and Warner. For over 27 years, she has sat on the Executive Church Board for Holy Trinity Serbian Orthodox Church in Youngstown, Ohio as the Recording Secretary. Her leisure time is spent with her grandchildren, church activities and flower gardening.

Brooke C. McMaster

Senior Client Service Specialist

Phone: 724.728.6564

Toll Free: 877.728.6564

E-mail: bmcmaster@dinuzzo.com